In the evolving landscape of insurance, parametric insurance represents a revolutionary approach that's changing how coverage works and how claims are paid. Unlike traditional insurance that reimburses based on actual losses after a lengthy assessment process, parametric insurance provides predetermined payouts when specific, measurable events occur. This innovative model offers speed, transparency, and certainty that traditional insurance often lacks.

Understanding Parametric Insurance

Parametric insurance is a type of insurance that pays out a fixed amount based on a specific trigger event, rather than based on the actual loss incurred. The "parameters" of the policy are predefined and measurable, such as wind speed reaching a certain threshold, rainfall exceeding a specific amount, or an earthquake of a particular magnitude.

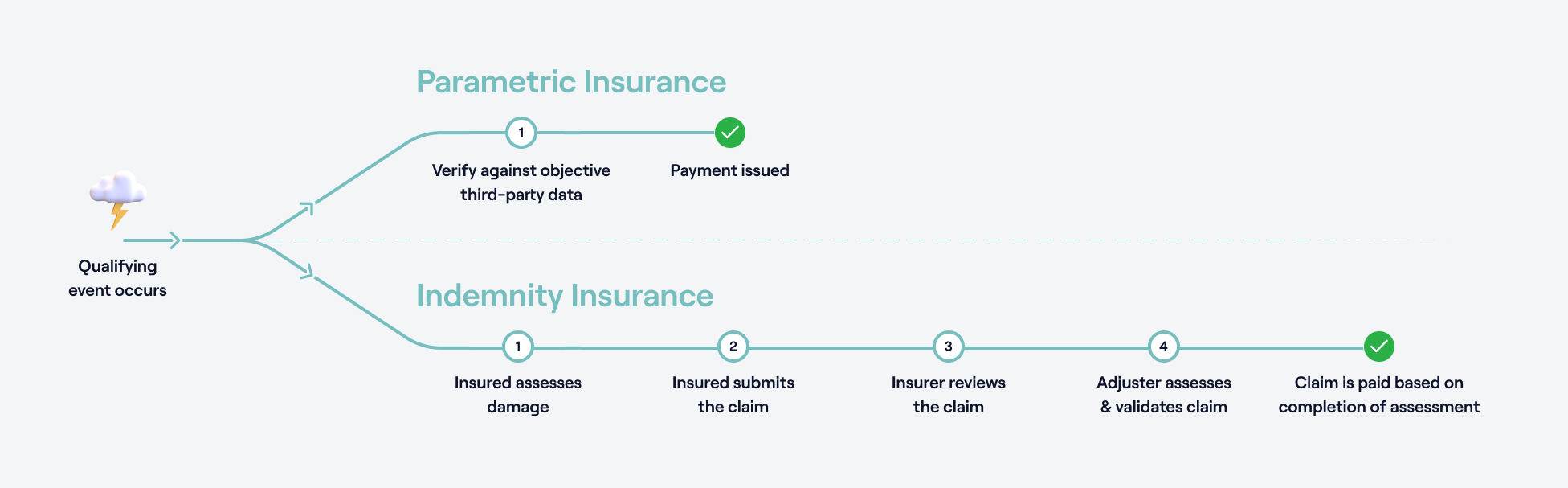

When these predefined parameters are met, the policy automatically triggers a payout, regardless of the actual damage or loss experienced. This eliminates the need for lengthy claims assessments, adjusters, and paperwork that typically follow traditional insurance claims.

Parametric vs. Traditional Insurance

The key differences between parametric and traditional insurance include:

Trigger Mechanism: Traditional insurance pays based on actual losses after assessment, while parametric insurance pays when specific, measurable parameters are met.

Payout Process: Traditional insurance requires claims filing, assessment, and approval, which can take weeks or months. Parametric insurance provides automatic payouts once trigger conditions are verified.

Certainty: With parametric insurance, you know exactly what you'll receive if a covered event occurs. Traditional insurance payouts may vary based on the assessment of actual damages.

Premiums: Parametric insurance premiums are often calculated differently, based on the probability of the trigger event occurring rather than potential loss amounts.

Types of Parametric Insurance

Parametric insurance is available for various types of risks, including:

Benefits of Parametric Insurance

Parametric insurance offers several advantages over traditional insurance:

Speed: Payouts occur automatically when trigger conditions are met, often within days rather than weeks or months.

Transparency: Policyholders know exactly what triggers a payout and how much they'll receive, eliminating uncertainty.

Simplicity: No complex claims process, paperwork, or assessments required.

Certainty: Guaranteed payout amount when trigger conditions are met, regardless of actual losses.

Accessibility: Often available for risks that are difficult to insure through traditional means.

Considerations and Limitations

While parametric insurance offers many benefits, it's important to understand its limitations:

Basis Risk: The payout may not match the actual loss incurred. For example, a hurricane policy might trigger a payout based on wind speed, but your actual damage might be from flooding, which isn't covered by the parametric trigger.

Premium Costs: Parametric insurance premiums can sometimes be higher than traditional insurance for similar coverage amounts.

Limited Coverage: Parametric policies only cover specific trigger events and may not provide comprehensive protection against all risks.

Parameter Selection: Choosing the right parameters for your policy is crucial and requires careful consideration of your specific risks.

How to Choose the Right Parametric Insurance

When considering parametric insurance, follow these steps:

The Future of Parametric Insurance

The parametric insurance market is rapidly evolving, with several exciting developments on the horizon:

Advanced Technology Integration: IoT devices, satellite imagery, and blockchain technology are making parameter verification more accurate and reliable.

Expanded Applications: New types of parametric insurance are emerging for previously uninsurable risks, such as cyber attacks, supply chain disruptions, and pandemic-related business interruptions.

Personalization: AI and machine learning are enabling more customized parametric policies tailored to individual needs and risk profiles.

Smart Contracts: Blockchain-based smart contracts are automating the entire insurance process, from premium payment to claim payout, further increasing efficiency and transparency.

Final Thoughts

Parametric insurance represents a significant innovation in the insurance industry, offering speed, transparency, and certainty that traditional insurance often lacks. By providing automatic payouts based on specific trigger events, it eliminates the lengthy claims process and provides immediate financial relief when covered events occur.

While parametric insurance may not be suitable for all situations, it can be an excellent complement to traditional insurance coverage, particularly for risks where speed and certainty of payout are essential. As technology continues to advance, we can expect parametric insurance to become more sophisticated, accessible, and integrated into our overall risk management strategies.

When considering parametric insurance, work with a qualified insurance professional who can help you assess your risks, select appropriate parameters, and determine the right coverage amount for your specific needs. With the right approach, parametric insurance can provide valuable protection and peace of mind in an uncertain world.